ESG Strategy and Governance

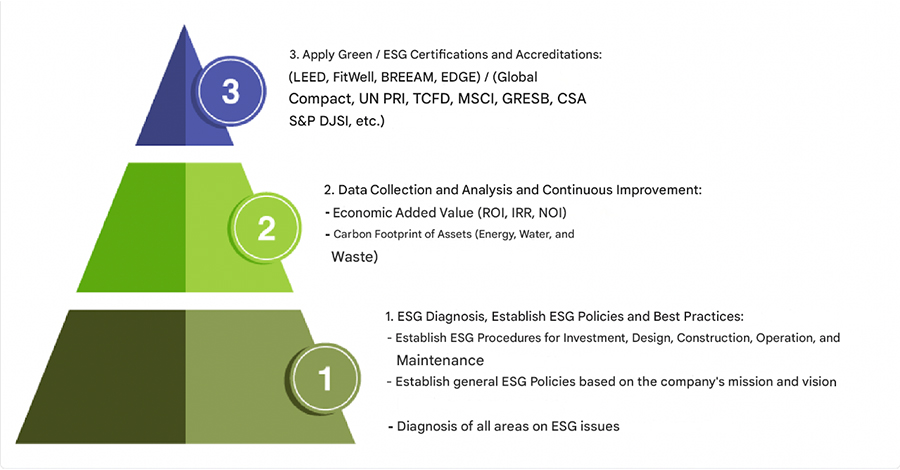

At PIIMA, we guide and support companies in the planning, development, implementation and management of their sustainability strategy, aligning their business objectives with the SDGs and establishing effective ESG policies and procedures. We promote environmentally responsible practices with resource (energy, water and waste) and social (communities and stakeholders) management, as well as the measurement of environmental KPIs and carbon footprint (GHG) minimization, enabling sustainable and efficient management.

Services

- Corporate ESG diagnosis

- Corporate ESG objectives

- Materiality Assessment

- Sustainability / ESG related policies

- Development of Responsible Investment policy and procedures

- Creation of ESG procedures

- Green clauses for leases

- Stakeholder engagement programs

- Environmental data collection program with tenants.

- Sustainability-focused satisfaction surveys for all stakeholders.

- Workshops and training with focus on ESG and sustainability.

Benefits:

- Increase corporate reputation

- Sense of belonging among employees and customers.

- Risk reduction and opportunity detection.

- Informed decision making

- Increased financial performance (IRR and NOI)

- Ease of obtaining financing and reporting ESG performance to investors.

- Direction to the fulfillment of ESG objectives.

Real Estate Sustainability

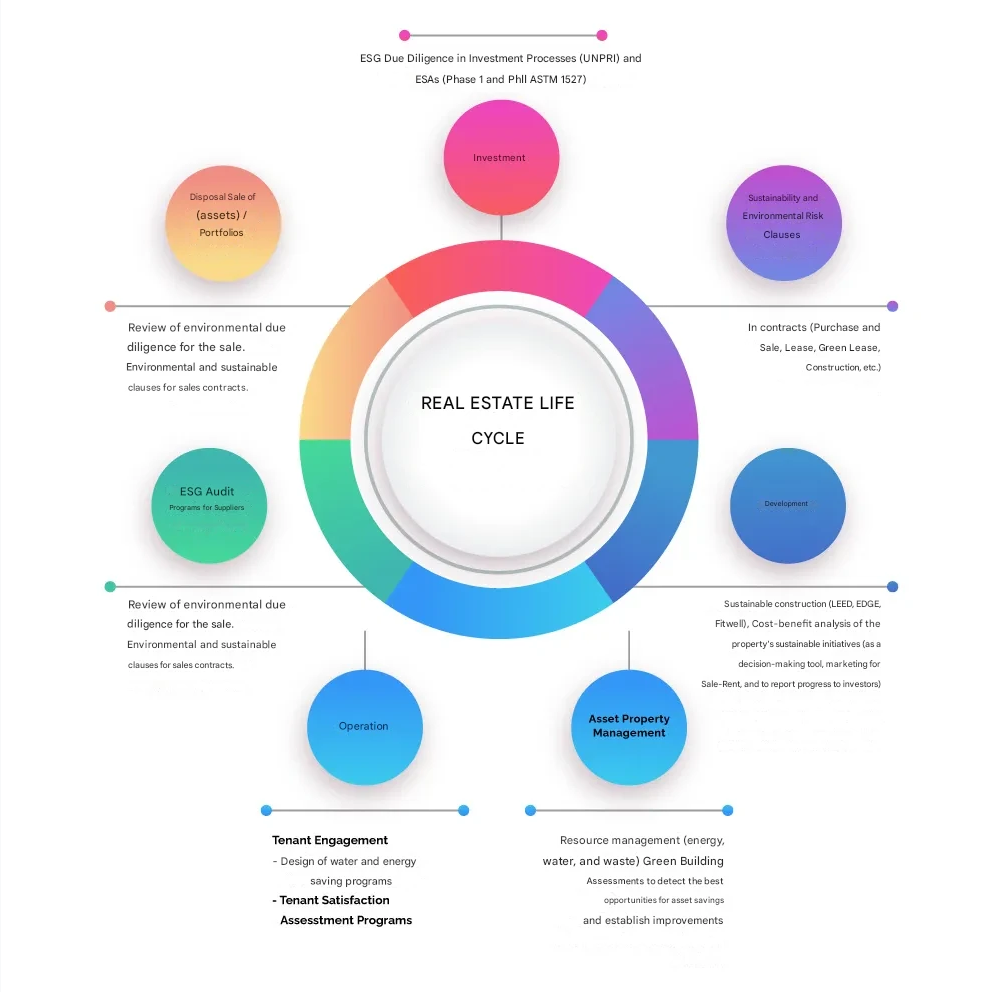

For real estate investment portfolios (such as REITs, CKDs, and others), it is essential to add value through risk-reduction strategies that address ESG (Environmental, Social, and Governance) factors throughout the real estate lifecycle.

Sustainable investing is about responsibility and recognizing the real estate sector’s potential to contribute to global climate and environmental goals. In a world experiencing rapid and exponential urbanization, the real estate industry stands at the center of unprecedented growth and activity.

Source: World Green Building Forum 2019

Benefits::

- Establish ESG policies and guidelines across the entire portfolio.

- Improve Net Operating Income (NOI) by reducing operating costs.

- Develop strategies at both the portfolio and asset levels.

- Identify and implement efficiency projects.

- Annual stakeholder engagement programs, including environmental, health, and wellness events.

- ESG program branding and sustainability positioning.

- Development of program goals and objectives.

- Annual Sustainability Reports aligned with GRI standards.

- Third-party ESG reporting, including GRESB, UNPRI, CSA, CDP, DJSI, among others.

- Sustainability Due Diligence for new acquisitions.

- Risk assessments for long-term investments.

- Climate change and resilience planning.

Risk, Resilience, and Climate Change Programs

Identification and definition of the company’s physical, social, and transition risks.

Development of action plans to address these risks (based on TCFD and GRESB frameworks)..

Materiality Assessment, Sustainability Reports, and Carbon Footprint

The value of sustainability reporting lies in ensuring that organizations consider their impacts on ESG factors, while allowing them to be transparent about the risks and opportunities they face. Today, organizations are expected to provide tangible and credible evidence of their sustainability performance by following proper reporting guidelines such as the Global Reporting Initiative (GRI) Standards, TCFD, TNFD, SASB, and IFRS.

Objective::

To meet the expectations of stakeholders, including business organizations, labor groups, NGOs, investors, clients, employees, and auditors.

Service Description:

- Defining the company's materiality and double materiality aspects

- Scope of work includes:

- Comparative study and evaluation of sustainability performance in relation to laws, standards, codes, performance guidelines, and voluntary initiatives

- Water and carbon footprint analysis (XXX)XXX)

- Demonstration of how an organization influences the expectations established regarding sustainable development.

- Comparison of an organization’s performance over time and against other organizations

Benefits:

- Establish the baseline for strategic planning

- Tool for decision-making, risk reduction, and ESG program implementation

- Supports the creation and strengthening of relationships with stakeholders—promoting transparency and credibility

- Creates opportunities for collaboration and integration across departments

- Elevates the internal importance of sustainability

- Demonstrate the company's commitment to sustainability and its stakeholders.

Sustainable Accreditations

Corporate ESG Accreditations

- Carbon Disclosure Project (CDP): A nonprofit organization that leads the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impact.https://www.cdp.net/)

- Global Real Estate Sustainability Benchmark (GRESB): The leading ESG benchmark for real estate and infrastructure investments worldwide. PIIMA is the only GRESB Partner in LatAm.www.gresb.com/)

- Corporate Sustainability Assessment (CSA), S&P Global: An assessment that establishes a sustainability baseline through key metrics and compares sustainable performance with industry peers. https://www.spglobal.com/esg/csa/ https://www.spglobal.com/esg/csa/

- United Nations Principles for Responsible Investment (UN PRI): The leading global initiative on responsible investment, helping understand the financial implications of ESG for decision-making.

- Task Force on Climate-related Financial Disclosure (TCFD): The TCFD recommendations strongly encourage the disclosure of financial information related to climate risks to enable investors to make decisions on a comparable basis.https://www.fsb-tcfd.org/)

- Dow Jones Sustainability Index (DJSI) & CSA SAM: Measures the ESG performance of publicly traded companies and global industry leaders. (https://www.spglobal.com/esg/csa/

- Task Force on Nature-related Financial Disclosure (TNFD): TNFD’s recommendations and guidance enable businesses and financial institutions to integrate nature into decision-making. (https://tnfd.global/)

- Global Compact: The UN Global Compact is the world’s largest corporate sustainability initiative. (http://www.pactomundial.org.mx/site/)

- CEMEFI: The Mexican Center for Philanthropy, which grants the Socially Responsible Company accreditation to Mexican businesses that meet ESG criteria in their operations.https://www.cemefi.org/esr/)

Benefits:

- Gain integration and buy-in from senior management on ESG initiatives.

- Achieve integration and buy-in from senior management on ESG initiatives

- Updated mapping and communication with the company’s stakeholders.

- Increase medium- and long-term operating performance (NOI), and therefore the portfolio’s value, along with social and environmental benefits.

- Consolidate, grow, and maintain relationships with investors and stakeholders.

- Reduction of the portfolio’s carbon footprint and higher scores in rankings such as CDP, GRESB, CSA, etc.

ESG Training

- At Piima, we design courses, workshops, lectures, and training sessions for audiences in the fields of Sustainability, Climate Change, Environmental Risk, Architecture, and Engineering.

- Tailor-made solutions for any business sector

- Some of our areas of expertise include:

- Corporate Sustainability

- Corporate Social Responsibility

- GRI Reports

- Carbon Footprint

- Eco-efficiency

- Sustainability in the Real Estate Lifecycle

- Environmental risk

- Resilience and Climate Change

Benefits:

- Raise awareness about the importance of ESG issues

- Prepare the company to face:

- Global challenges

- Legal compliance that will become increasingly stringent.

- Customer demands for efficiency and sustainability.

- Develop comprehensive sustainability strategies within the organization, as support from all departments is required.